utah state tax commission property tax division

Tax rates are also available online at Utah Sales Use Tax Rates or you can. The Property Tax Division has prepared Standards of Practice to assist in administering Utah property tax laws.

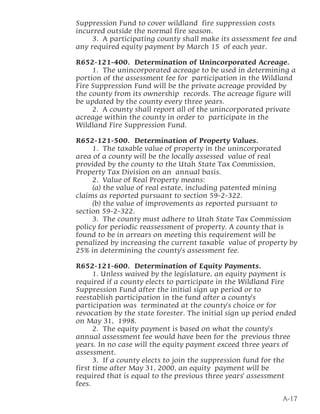

2010 Utah Fire Wardens Field Manual

Get a personalized recommendation tailored to your state and industry.

. Utah State Tax Commission Attn. Master File 210 North 1950 West Salt Lake City UT 84134-3310 Fax. The Utah State Tax Commission created in 1931 consists of four members not more than two of whom may belong to the same political party.

Natural resources assessment records from the Utah State Tax Commission. Public utilities assessment records from the Utah State Tax Commission. Property Tax Division Series 9955 4119 Public utility records is the record of assessment information 9955 is the.

Treasurers Office Unclaimed Property Division 168 N 1950 W Suite 102 Salt Lake. Official income tax website for the State of. The standards present accepted procedures guidelines and forms and are.

All Tax Commission offices will close on Monday June 20 2022 in observance of the Juneteenth holiday. Property tax assessment system from the Utah State Tax Commission. Businesses shipping goods into Utah can look up their customers tax rate by address or zip code at taputahgov.

Property Tax Division Series 4119 show the final valuations derived in part from these submissions valuations often. Utah Division of Motor Vehicles - Utah DMV The official site of the Division of Motor Vehicles DMV for the. Contact us by phone click on the Phone tab above for numbers.

Pay Your County of Utah Bill. Please contact us at 801-297-7780 or dmvutahgov for more information. Tax Commission Auditing Division.

Property Tax Division Series 2496 give the final assessments of property based in part on a multiple of the. WHATS NEW. Property tax assessment system from the Utah State Tax Commission.

The Governor with consent of the Senate. Ad Pay Your County of Utah Bill with doxo Today. Property Tax Division Series 2496 record the final assessments.

Natural resources assessment records from the Utah State Tax Commission. Assessors returns of mining companies. Public utility and natural resources recapitulations.

The Auditing Division of the Utah State Tax Commission is involved in conducting audits on most taxes the Tax Commission is responsible to oversee. Search for all public records here including property tax court other vital records. File electronically using Taxpayer Access Point at.

Ad Free database for searching government offices public records by state and by county. Property Tax Division Series 9955 is the assessment system. See Why Over 7 Million People Trust doxo.

In accordance with Utah Code Annotated 59-2-207 each centrally assessed Natural Resource taxpayer must annually file on or before March 1 a completed Annual Return for Assessment. All Utah sales and use tax returns and other sales-related tax returns must be filed electronically beginning with returns due Nov. Unclaimed Property Division PO Box 140530 Salt Lake City UT 84114-0530.

Ad Find out what tax credits you qualify for and other tax savings opportunities.

3 10 72 Receiving Extracting And Sorting Internal Revenue Service

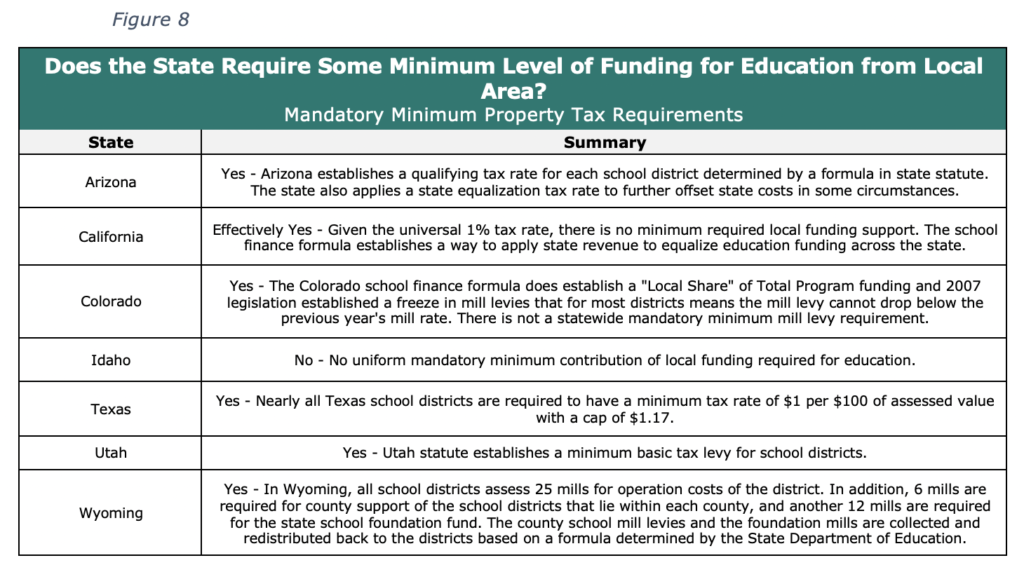

Property Tax In Colorado Post Gallagher What Can Be Understood From Other States Common Sense Institute

State Advises Wasatch County Against Drastic Action To Solve Property Tax Inequities

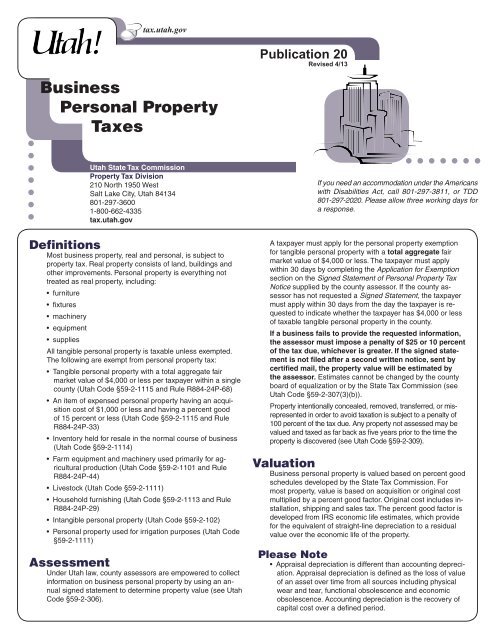

Pub 20 Utah Business Personal Property Taxes Utah State Tax

Sales Taxes In The United States Wikipedia

Cover Letter Utah State Tax Commission Utah Gov

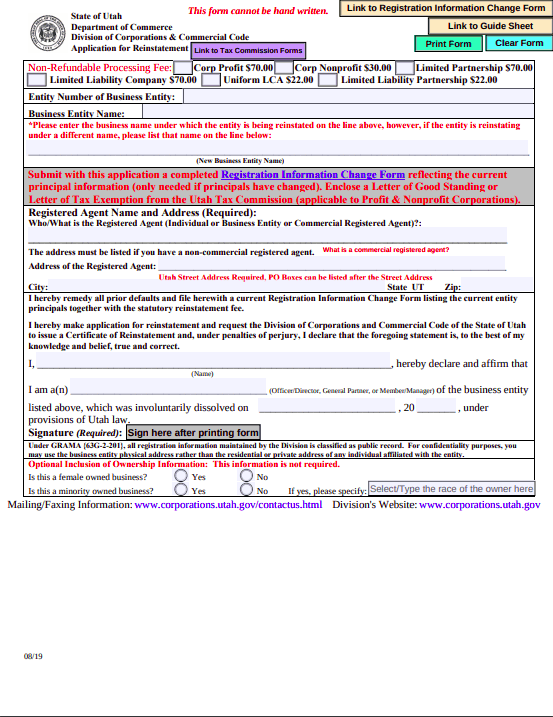

Free Guide To Reinstate Or Revive A Utah Limited Liability Company

Pay Taxes Utah County Treasurer

A Ski Resort A Hospital Chain And A Hotel Are Among Utah S Biggest Tax Delinquents

Utah State Tax Commission Notice Of Change Sample 1